Margex Exchange Review 2025: Honest Thoughts from Real Users

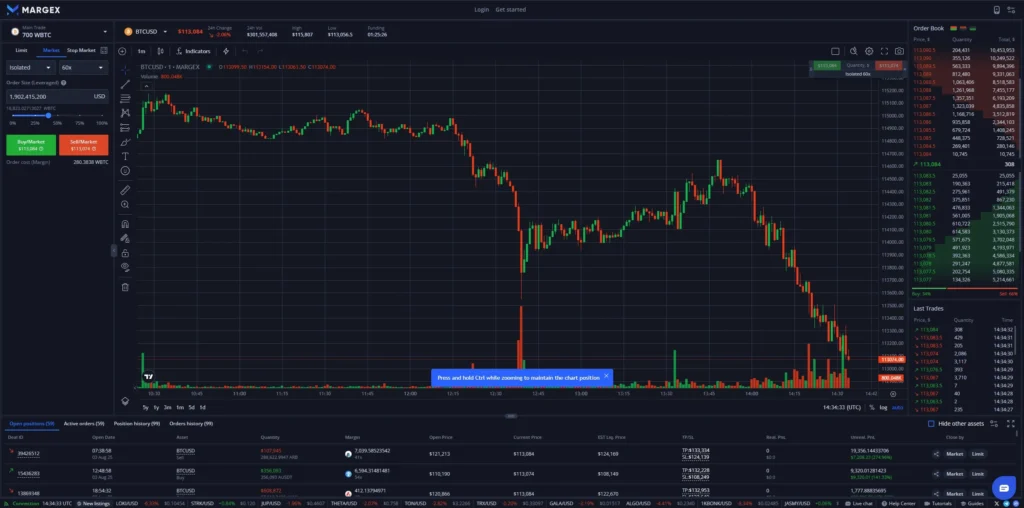

When people talk about Margex Exchange Review 2025, the conversation usually starts with trust. Margex came into the scene promising a smooth margin trading experience, but over time it’s had to prove that it can keep user funds safe and trades running efficiently. Early users remember a simpler platform with fewer features and occasional liquidity issues, while today, many say the trading flow feels much smoother, with faster execution and a cleaner interface.

Traders often mention that Margex gives them the freedom to put up Bitcoin, ETH, or stablecoins as collateral. This makes it quicker to start a trade because they don’t have to waste time swapping coins first. They also note the fees aren’t too steep, and with leverage that can go as high as 100x, both newcomers testing the waters and seasoned risk-takers find enough room to trade the way they like.

Margex Security: What Works and What Still Needs Work

Margex keeps most funds in cold wallets, adding several verification layers to withdrawals. These steps slow down cash-outs slightly, but many traders feel safer knowing it’s harder for unauthorized access to happen. After events like the FTX collapse shook the industry, this added caution is generally appreciated.

Regulation is a mixed bag. Margex is taking steps to get more licenses globally, with talks about entering stricter markets like Singapore. But in many countries, crypto laws remain vague. Traders worry that sudden rule changes could disrupt access or force unexpected KYC requirements.

Fees and Leverage: Competitive but Not Always Best

Fees on Margex are fair, around 0.1% for spot trades and slightly lower for derivatives. Futures traders can use up to 100x leverage, but experienced users repeatedly warn against maxing out unless you’re ready for major risks. Over the past year, liquidity has improved, meaning big trades now face less slippage compared to earlier days.

| Exchange | Spot Fees | Derivatives Fees | Max Leverage |

|---|---|---|---|

| Margex | 0.1% / 0.1% | 0.02% / 0.06% | 100x |

| Bybit | 0.1% / 0.1% | 0.01% / 0.06% | 100x |

| Binance | 0.1% / 0.1% | 0.02% / 0.07% | 125x |

Margex Exchange Review: What Users Like About Margex

A lot of regular traders say Margex is pretty simple to figure out. The layout feels clean, and the platform offers basic guides that are easy to follow without too much technical talk. People like being able to pick their own type of collateral and appreciate having tools like isolated margin and stop-loss orders to keep trades from blowing up during big market swings. In the past year, support has gotten quicker to respond, so users don’t feel like they’re stuck waiting forever during fast market moves.

Margex Exchange Review: What Still Needs Fixing

Margex doesn’t yet match the big players for trading volume or extras like copy trading and in-depth analytics tools. KYC rules can feel inconsistent depending on your country, which often leaves newcomers puzzled about what documents they’ll need. During heavy market activity, a few traders have mentioned the site slowing down, suggesting its tech still has catching up to do.

Final Take: Is Margex Worth It in 2025?

After looking closely at Margex Exchange Review 2025, the platform feels more reliable than it did in its early days. Security layers, fair fees, and wider collateral options make it a strong choice for margin trading. It’s not as big or feature-rich as Binance or Bybit, but many traders like its straightforward setup and flexibility.

For serious trading activity, Margex holds up well. For long-term holdings, most users still recommend cold wallets. But if you’re looking to trade actively with leverage in 2025, Margex is a platform worth trying.